Predicting stock market falls using Wikipedia

Researchers from the UK and the US claim to have found a link between reader activity on Wikipedia and subsequent stock market changes.

The researchers found financially related Wikipedia pages experienced an increase in views before falls on the stock market.

The researchers - Suzy Moat and Tobias Preis from the University of Warwick, and Chester Curme, Adam Avakian, Dror Y Kenett and H Eugene Stanley from Boston University - documented their findings in a paper titled ‘Quantifying Wikipedia Usage Patterns Before Stock Market Moves’, published in Scientific Reports.

The researchers looked at how often 30 Wikipedia pages describing companies listed in the Dow Jones Industrial Average were viewed between December 2007 and April 2012. This information is provided by Wikipedia itself.

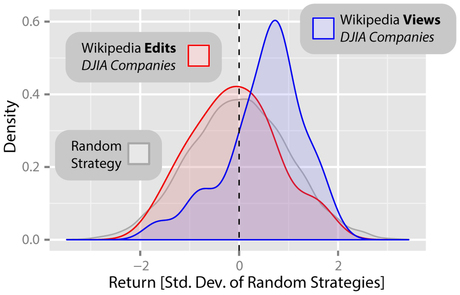

They compared these figures with movements in the stock market and found that a trading strategy based on changes in the frequency of views would have led to profits of up to 141%.

They also found that trading based on views of 285 pages relating to general financial topics - like macroeconomics, capital and wealth - would have led to profits of up to 297%.

A ‘buy and hold’ strategy - where an investor buys stock and keeps it over a long period of time - would have only accrued 3% profit in that same timeframe, the researchers said.

The researchers found no evidence of any link between the editing of pages and subsequent stock market movements.

In attempting to explain these results, the researchers said, “Wikipedia records may provide a proxy measurement of the information-gathering process of a subset of investors for the investigated period”.

“Our latest results provide further evidence that data on online information-gathering may contain precursors of collective decisions taken in the real world,” Preis said.

The full text of the paper, including a detailed discussion of the results, is available here.

Image courtesy of nature.com

Making sure your conversational AI measures up

Measuring the quality of an AI bot and improving on it incrementally is key to helping businesses...

Digital experience is the new boardroom metric

Business leaders are demanding total IT-business alignment as digital experience becomes a key...

Data quality is the key to generative AI success

The success of generative AI projects is strongly dependent on the quality of the data the models...