Cloud IT infrastructure nabs majority market share in Q319

Cloud IT infrastructure revenue exceeded spending on non-cloud IT infrastructure for the second time ever recorded, despite having declined for a second consecutive quarter in 2019, according to the International Data Corporation (IDC).

Cloud server, enterprise storage and Ethernet switch sales generated 53.4% of all IT infrastructure vendor revenue in quarter three last year (Q319), even as sales fell 1.8% year-on-year to $16.8 billion.

It’s only the second time cloud IT infrastructure spending has nabbed the majority share since IDC started tracking IT infrastructure deployments, with the first occurring in Q318. However, IDC believes 2020 could see cloud IT infrastructure spending stay consistently in the 50%+ range.

Of cloud IT infrastructure spending, private cloud has shown more stable growth than its public counterpart, increasing 3.2% year-on-year to reach nearly $5 billion. Overall, IDC expects spending in the private cloud segment to have grown 7.2% year-on-year to $21.4 billion in 2019.

Meanwhile, public cloud spending fell 3.7% year-on-year in Q319, driving the decrease seen in the overarching cloud segment. It follows the public and overall cloud segments’ harder fall in Q219.

Despite the lacking performance, IDC said the overall cloud IT segment is trending up, with public cloud susceptible to increased volatility each quarter as a few hyperscale service providers dominate a significant part of the segment.

“This softness of the public cloud IT segment is aligned with IDC’s expectation of a slowdown in this segment in 2019 after a strong performance in 2018. It is expected to reach $44 billion in sales for the full year 2019, a decline of 3.3% from 2018,” IDC said.

As a result, IDC slightly increased its forecast for total spending on public and private cloud IT infrastructure in 2019 to $65.4 billion, representing a flat performance compared to 2018.

Across the three cloud IT infrastructure domains, Ethernet switches is the only segment expected to deliver year-over-year growth in 2019, up 11.2%, while compute platform spending will decline 3.1% and storage spending will grow 0.8%. Compute platforms remain the largest category of cloud IT infrastructure spending at $34.1 billion, according to IDC.

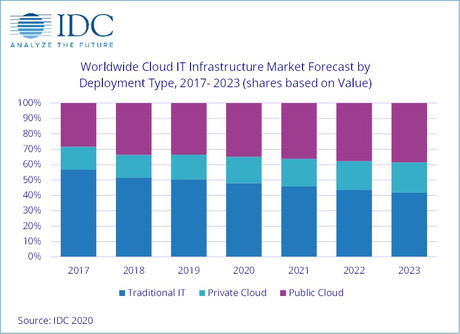

Non-cloud IT environment sales also declined 7.7% year-on-year in Q319, with worldwide spending expected to drop by 5.3% in 2019 overall. By 2023, IDC expects that traditional non-cloud IT-infrastructure will represent just 41.9% of the total IT infrastructure market worldwide. The market shift from non-cloud to cloud-based IT infrastructure is common across all regions, IDC said; however, the company believes certain types of workloads, business practices and sometimes end-user inertia will keep demand for traditional, dedicated IT infrastructure afloat.

DXC deploys Amazon Quick across entire workforce

DXC Technology has collaborated with Amazon to deploy the agentic AI platform Amazon Quick...

Logicalis launches technology assurance services

Logicalis Australia's new TAS unit will provide consulting-led services aimed at helping...

Snowflake enters $200m partnership with OpenAI

Snowflake and OpenAI have agreed to collaborate to provide advanced AI model capabilities for...