Australia to be nearly cashless within 5 years

Australia is well on the way to becoming a cashless society, with the total amount of cash receivables reported by Australian merchants shrinking 46% between 2010 and 2016, new research indicates.

The research from market analyst East & Partners predicts that at this rate, cash payments across all Australian businesses will fall to below 5% of total receivables by 2019 and to 2% within the next five years.

Between 2010 and 2016, credit card payment totals have meanwhile declined by 11%, while debit card receivables have surged by 56%, reflecting growing adoption of electronic payments as a direct cash substitute.

“Backed by recent figures from the Reserve Bank showing ATM withdrawals falling to all-time lows, East’s research indicates that cash is increasingly vanishing as a preferred payment method,” East and Partners Head of Markets Analysis Martin Smith commented.

“As consumers continue to embrace platforms such as wearables, contactless and mobile payments, and they’re further integrated into everyday life, the need to carry cash will continue to diminish at an accelerating rate.”

He said the Reserve Bank’s decision to limit the surcharges companies can charge to collect electronic payments to the amount it costs the business to manage the transaction will further spur adoption.

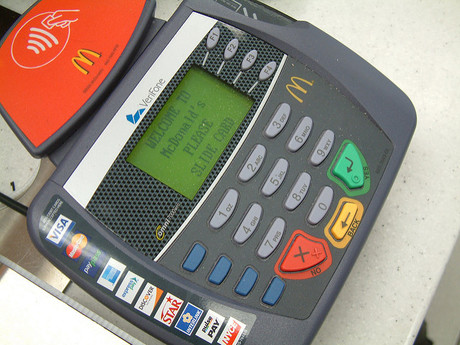

While the big banks control the point-of-sale terminal market, non-bank providers such as PayPal, Tyro and new market entrant Square Payments are putting up a fight, Smith said.

Meanwhile, the percentage of Australian businesses either accepting or planning to accept online payments has meanwhile climbed from 15% in 2010 to 82% today, the report shows. But only one in five Australian merchants have ‘mobile friendly’ browsing functionality for their web presence.

“Despite Australia’s rapid adoption of mobile devices, it’s disappointing to see so few small businesses meeting demand. However, that provides a distinct opportunity for payment platform providers to step in, educate and enhance these businesses’ competitiveness against larger more digitally enabled enterprises,” Smith said.

Anthropic opening Australian office

AI safety and research company Anthropic is opening an office in Sydney to be able to better...

TeamViewer integrates further with Microsoft Intune

TeamViewer has announced a deeper integration with Microsoft Intune to enable IT teams to use...

11:11 Systems buys Digital Sense

Managed infrastructure solutions provider 11:11 Systems has acquired cloud and managed...